Glimpse provides search trends in a similar fashion as Treendly or Exploding Topics, but separates them into companies, products, and industries.

There seem to be several sources at play.Įxploding Topics also provides you the rate of monthly growth and exponential growth, which can be very helpful to access how quickly a topic is growing. However, the trends data is not just a pull from Google Trends. I compared the searches/mo (see screenshot below) and found that it seems to be Keyword Planner search volume. The data is very helpful, though it’s not clear what all the data sources are Exploding Topics uses. Then there are also forum discussions, which I can see helpful from many perspectives:Įxploding topics was bought by Brian Dean from Backlinko back when it was still called Trennds. It gives you historical trends (relative), forecasts, and related searches.Įspecially for keyword research, those come in handy. Treendly combines data from Google Trends, News, Twitter, Youtube, and Amazon.

#Google trends alternative free

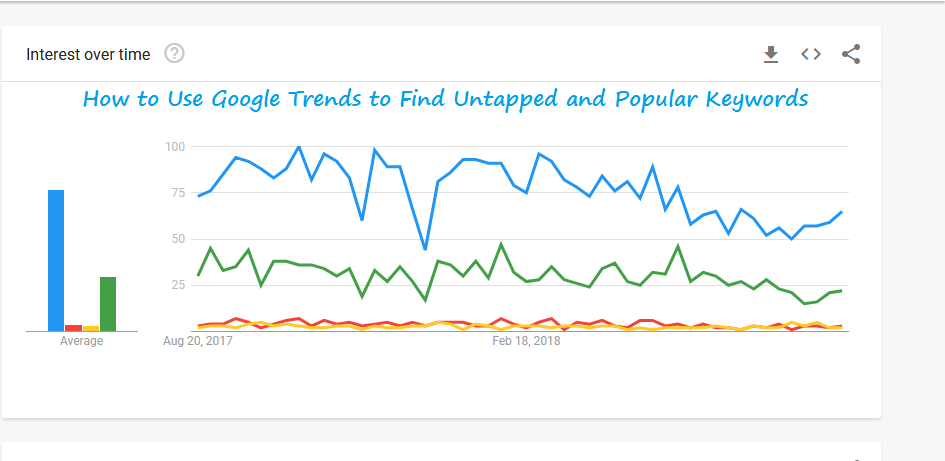

Hashtagify comes with tons of valuable information, even with just a free account. Not only do I find the related hashtags very insightful but also the popularity trend over time. That might exclude “boring” products, but give us another source of data points to expand market research. Why not look at social data? I think demand can be measured very well on social networks, as long as the product is talked about in any way. One of the most annoying things about Google Trends is that the data is not easy to export or measure at scale. It contains a lot of interesting information that’s otherwise hard to get.Īnd then, of course, there are related queries that can really help you in keyword research (just not at scale). On top of that, use the maps feature if geo areas are important to you in the slightest way. In worst case, use another rank tracker tool to get the search volume for a keyword and then extrapolate to the trend. Even though the data is normalized on a relative scale, comparison is still very powerful. I find a lot of value in the often-overlooked data from Image, News, and Youtube Search. Of course, I have to mention Google Trends, which has gained a lot of popularity during the COVID-19 crisis when consumer demand shifted quickly and search volume data wasn’t available fast enough. eBay gives you the actual number of searches but limits the time range to the last 7 days or less.īesides that, eBay also gives you an idea how much a product is worth. The platform provides data for the US, Australia, UK, and Germany. Where Pinterest Trends shines for health and adjacent topics, eBay explore is great for e-commerce-related data.

Just like Pinterest, eBay launched its own version of a product exploration platform. The limitation is that you’d find more and better data for topics that Pinterest is mainly used for: health, food, fashion, inspiration, quotes, etc.įor general inspiration, take a look at the top 100 Trends on Pinterest (similar to the Google homepage). The data seems very much on par with Google Trends and is also normalized to a scale of 0 to 100. It was only available in the US until recently and now also offers data for Canada and the U.K. Pinterest recently published its own version of Google Trends. There are probably even more limitations that I haven’t listed and yet, we still rely on search volume for too many decisions.

it combines related keywords and accumulates their search volume.not very accurate in the first place and when you don’t pay for Google Ads, the ranges are way too broad.compromised by rank tracker that crawl the search results and inflate it.Let’s face it: Google Keyword Planner search volume is flawed.

0 kommentar(er)

0 kommentar(er)